Spanish Inheritance Law, known as inheritance law in Spain, covers the rules and regulations governing asset transfer after death. This includes the inheritance tax (IHT), also called succession tax in Spain or death duties. Understanding the intricacies of hereditary tax, such as inheritance tax in Spain for non-residents, is crucial for effective estate planning.

Key considerations include the timeline for IHT, potential penalties for late payment, and whether IHT rates are uniform across Spain. Determining which regional law applies to your case and calculating IHT accurately are essential steps.

Factors that influence IHT allowances in Spain and the availability of other tax allowances can significantly impact the amount owed. By exploring how to avoid inheritance tax in Spain and understanding these elements, one can better navigate the complexities of Spanish inheritance law.

Expert Legal Advice: Navigating Spanish Inheritance Law

Navigating the complexities of inheritance law in Spain requires expert legal advice to ensure compliance with IHT tax regulations and to optimize strategies for minimizing tax liabilities. Here’s a breakdown of key considerations:

Understanding Inheritance Law in Spain

Inheritance law in Spain governs how assets are distributed after someone passes away. It encompasses rules and regulations regarding transferring property, financial assets, and other inheritable items to beneficiaries.

One crucial aspect of inheritance law is the imposition of taxes, commonly referred to as Inheritance Tax (IHT) or succession tax. These taxes can significantly impact the amount beneficiaries receive.

IHT Tax: What You Need to Know

Inheritance Tax (IHT) in Spain, also known as hereditary tax, is levied on transferring assets from a deceased person to their heirs. The tax rates and rules vary depending on several factors, including the value of the inheritance, the relationship between the deceased and the beneficiary, and the region in Spain where the beneficiary resides. Understanding these intricacies is essential for effective estate planning and minimizing tax liabilities.

Timeline for IHT in Spain

The timeline for paying Inheritance Tax in Spain begins upon the individual’s death. Beneficiaries typically have a limited timeframe to file and settle their tax obligations, which varies by region and depends on the specific circumstances of the inheritance. Timely compliance is crucial to avoid penalties and interest charges that may accrue for late payments.

Late Payment Penalties: Are There Consequences?

Failure to pay Inheritance Tax on time in Spain can result in penalties and additional costs. These penalties are typically calculated based on the amount of tax owed and the delay duration.

To avoid unnecessary expenses and legal complications, beneficiaries should adhere to the prescribed timelines for tax payment and seek professional guidance if unsure about their obligations.

Regional Variations in IHT: Understanding the Differences

Inheritance Tax regulations in Spain are not uniform across the country; they vary significantly from one autonomous community to another. Each region has its own set of rules regarding tax rates, exemptions, and allowances applicable to inheritances. Therefore, it’s essential to understand the specific regulations for the region where the deceased or beneficiary resides.

Determining Your Regional IHT Law

Determining which regional Inheritance Tax law applies to a specific case requires careful consideration of several factors, including the deceased’s domicile and the beneficiary’s residency status.

Different regions in Spain have distinct laws governing Inheritance Tax, influencing the overall tax liability and potential exemptions available to beneficiaries.

Tax Differences Between Residents and Non-Residents

In Spain, the tax treatment of inheritances can vary significantly between residents and non-residents. Non-residents may face higher Inheritance Tax rates and fewer tax exemptions than residents.

Understanding these differences is crucial for non-resident beneficiaries to effectively plan for potential tax liabilities and explore strategies to minimize their impact.

Calculating IHT: A Practical Guide

Calculating Inheritance Tax in Spain involves determining the taxable base, applying relevant tax rates, and considering any applicable deductions or allowances.

The taxable base typically includes the total value of the inheritance after deducting liabilities and certain allowable expenses.

Beneficiaries can consult with tax advisors or legal professionals experienced in Spanish tax law to ensure accurate calculation and compliance with regulatory requirements.

Factors Influencing IHT Allowances

Several factors influence the Inheritance Tax allowances and deductions available to beneficiaries in Spain. These factors may include the relationship between the deceased and the beneficiary, the value of the inheritance, and specific regional regulations. Understanding these influences enables beneficiaries to maximize available tax benefits and effectively manage their tax obligations.

Additional Tax Allowances Available

In addition to standard Inheritance Tax allowances, Spain offers additional allowances and exemptions that can further reduce beneficiaries’ overall tax burden.

These allowances may include specific deductions for certain types of assets, such as the main family home or business interests, as well as exemptions based on the beneficiary’s age or disability status.

Exploring these additional allowances and exemptions is essential for beneficiaries seeking to optimize their tax planning strategies and minimize their Inheritance Tax liabilities.

How Inheritance Tax Works in Spain?

Inheritance Tax (IHT) in Spain is levied on transferring assets from a deceased person to their beneficiaries. Understanding how this tax works involves several key aspects:

Taxable Events and Beneficiaries

Inheritance Tax in Spain becomes applicable upon an individual’s death. The transfer of assets to beneficiaries triggers tax obligations. Beneficiaries who receive inheritances are responsible for reporting and paying the tax to the relevant tax authority.

Determination of Taxable Base

The taxable base for Inheritance Tax is calculated based on the net value of the inheritance received by each beneficiary. This includes the total value of all inherited assets after subtracting any debts, funeral expenses, and allowable deductions permitted under regional tax laws.

Graduated Tax Rates

In Spain, Inheritance Tax rates are progressive, meaning they increase with the value of the inheritance and vary depending on the relationship between the deceased and the beneficiary. Immediate family members such as spouses and children typically benefit from lower tax rates and higher exemptions compared to more distant relatives or unrelated beneficiaries.

Regional Variations in Taxation

One notable aspect of the Inheritance Tax in Spain is its regional autonomy. Each autonomous community (region) has the authority to establish tax rates, exemptions, and allowances for Inheritance Tax.

This leads to significant variations in tax liabilities depending on where the deceased was domiciled or where the beneficiary resides.

Calculation Methodology

Calculating Inheritance Tax involves applying the appropriate tax rates to the taxable base determined for each beneficiary. The process requires careful consideration of regional regulations to ensure accurate compliance and optimize tax planning strategies.

Tax Planning Strategies

Effective tax planning can help mitigate Inheritance Tax liabilities in Spain. Strategies include:

- Making lifetime gifts to reduce the taxable estate.

- Structuring assets within tax-efficient legal entities like trusts or family companies.

- Taking advantage of available allowances and exemptions.

Legal and Financial Advice

Inheritance Tax in Spain can be complex due to regional differences and evolving tax laws. Beneficiaries are encouraged to seek professional advice from tax advisors and legal experts specializing in Spanish tax law to ensure compliance with regulations, maximize tax efficiency, and protect inherited assets.

Understanding how the Inheritance Tax works in Spain involves grasping the fundamental principles of taxation, regional variations in tax laws, calculation methodologies, and strategic tax planning.

By staying informed and consulting with experts, beneficiaries can navigate the complexities of Inheritance Tax effectively and make informed decisions to optimize their financial outcomes.

Timeline for Spanish Inheritance Tax: Key Steps

Understanding the Spanish Inheritance Tax (IHT) timeline is crucial for beneficiaries to navigate the process effectively and comply with legal requirements. Here are the key steps involved:

1: Notification of Death

The timeline for the Spanish Inheritance Tax begins with the notification of the individual’s death. This initiates the process of settling the deceased’s estate and determining the tax obligations of the beneficiaries.

2: Identification of Beneficiaries

Once the death has been notified, beneficiaries need to be identified. This involves determining who will inherit the deceased’s assets and understanding their respective entitlements under the estate.

3: Assessment of Estate Assets

After identifying the beneficiaries, the next step is to assess the total value of the estate assets. This includes all inheritable assets such as real estate, financial investments, personal belongings, and any liabilities or debts of the deceased.

4: Calculation of Inheritance Tax

The next step is to calculate the Inheritance Tax payable by each beneficiary based on the assessed value of the estate assets. The calculation considers factors such as the relationship between the deceased and the beneficiary, the value of the inheritance, and any applicable deductions or exemptions.

5: Filing and Submission

Once the Inheritance Tax liability has been calculated, beneficiaries must file and submit the relevant tax forms to the appropriate tax authority within the designated timeframe stipulated by regional regulations.

6: Payment of Tax

After filing the necessary tax forms, beneficiaries must pay Inheritance Tax to the tax authority. Ensuring that the tax payment is made within the specified deadline is essential to avoid penalties or interest charges for late payments.

7: Tax Assessment and Confirmation

Upon receiving the tax forms and payment, the tax authority assesses the information provided and confirms the acceptance of the tax declaration. This confirmation signifies the completion of the Inheritance Tax process for the beneficiaries.

8: Distribution of Assets

Once the Inheritance Tax obligations have been fulfilled, the final step is to distribute assets to the beneficiaries according to the terms of the deceased’s will or applicable inheritance laws. This includes transferring inherited asset ownership and ensuring legal transfer procedures are completed.

The timeline for Spanish Inheritance Tax can be complex, especially given regional variations and evolving tax laws. Beneficiaries are strongly advised to seek professional assistance from tax advisors and legal experts specializing in Spanish inheritance law.

This ensures compliance with regulatory requirements, optimizes tax planning strategies, and protects the interests of all parties involved in the inheritance process.

Late Payment Penalties: What You Should Know

Understanding the consequences of late payment in Spain’s Inheritance Tax (IHT) is crucial to avoid unnecessary financial penalties. Here are the key aspects to consider:

Penalty Calculation

Late payment penalties for Inheritance Tax in Spain are typically calculated based on the amount of tax owed and the delay duration. The exact penalty rates may vary depending on regional regulations and the specific circumstances of the late payment.

Accrual of Interest

In addition to penalties, late payments of Inheritance Tax may also accrue interest charges. These charges are applied to the outstanding tax amount and can accumulate until the tax liability is settled in full.

Legal Consequences

Failure to pay the Inheritance Tax on time can have legal consequences, including potential enforcement actions by the tax authorities. Beneficiaries must be aware of their payment obligations and ensure timely compliance to avoid legal complications.

Mitigation Strategies

Beneficiaries should prioritize timely filing and payment of inheritance tax to mitigate the impact of late payment penalties. Seeking professional advice from tax advisors can help them understand payment deadlines and implement strategies to ensure compliance with regulatory requirements.

Is Inheritance Tax Uniform Across Spain?

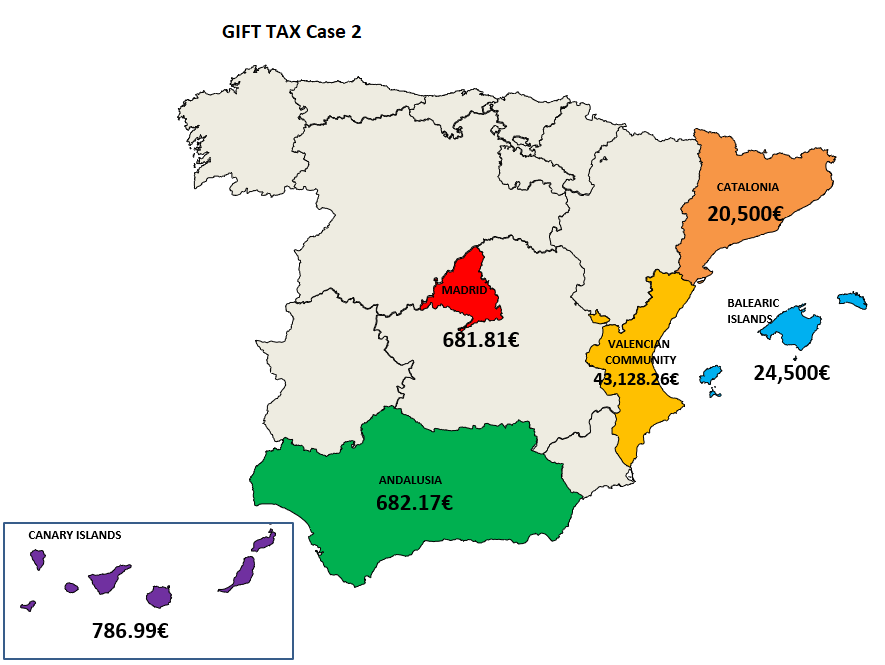

Inheritance Tax regulations in Spain are not uniform and can vary significantly between autonomous communities (regions). Here’s what you need to know about these variations:

Regional Autonomy

Each autonomous community in Spain has the authority to establish its own Inheritance Tax rates, exemptions, and allowances. This regional autonomy results in substantial differences in beneficiary tax liabilities depending on where the deceased was domiciled or where the beneficiary resides.

Impact on Tax Liabilities

Regional variation in Inheritance Tax can impact beneficiaries’ overall tax liability. Some regions may offer more favorable tax rates and higher exemptions, while others may have stricter tax regulations, resulting in higher tax burdens.

Planning Considerations

Understanding the specific Inheritance Tax regulations of the relevant region is crucial for effective tax planning. Beneficiaries may consider residency and asset planning strategies to optimize tax efficiency and minimize tax liabilities based on regional differences.

Legal Advice

Given the complexities of regional variations in Inheritance Tax, beneficiaries are advised to seek legal advice from professionals familiar with Spanish tax law. This ensures compliance with regional regulations and enables beneficiaries to make informed decisions regarding their inheritance planning.

Choosing the Right Regional Inheritance Tax Law

Selecting the appropriate regional Inheritance Tax law in Spain requires careful consideration of several factors. Here’s a guide to making this decision:

Determining Applicable Law

The applicable regional Inheritance Tax law is typically determined based on the deceased’s domicile at the time of death. Beneficiaries should identify the specific autonomous community where the deceased lived to understand which regional regulations apply.

Comparing Regional Regulations

Beneficiaries should compare the Inheritance Tax rates, exemptions, and allowances offered by different autonomous communities. This comparison helps in assessing potential tax liabilities and identifying regions with more favorable tax treatment.

Residency Considerations

Suppose beneficiaries reside in a different region from where the deceased was domiciled. In that case, they may have the option to choose between the regional laws of their residence or the deceased’s domicile. This choice can impact the overall tax planning strategy and should be evaluated carefully.

Consulting Tax Advisors

When choosing the right regional inheritance tax law, it is recommended that you consult with tax advisors or legal professionals specializing in Spanish tax law. These professionals can provide personalized guidance based on individual circumstances and regional regulations to optimize tax planning and compliance.

Regional Inheritance Tax Insights Across Spain

Navigating Inheritance Tax (IHT) across different regions in Spain requires understanding the unique regulations and variations in tax rates, exemptions, and allowances. Here’s an overview of key considerations for each area:

Andalucia: Inheritance Tax Essentials

In Andalucia, understanding Inheritance Tax (IHT) is crucial for beneficiaries navigating estate planning and asset transfers. The region imposes tax rates and thresholds, which vary depending on the relationship between the deceased and the beneficiary.

Immediate family members such as spouses and children typically benefit from lower tax rates and higher exemptions compared to more distant relatives or non-relatives. Specific allowances may apply, such as deductions for primary residences and family-owned businesses, aiming to facilitate the transfer of assets while minimizing tax liabilities.

Beneficiaries in Andalucia should consult with tax advisors or legal experts familiar with regional tax laws to optimize their tax planning strategies and ensure compliance with regulatory requirements.

Aragon: Understanding Local Inheritance Tax

Navigating Inheritance Tax (IHT) in Aragon involves adhering to the region’s specific tax regulations governing the transfer of assets from deceased individuals to beneficiaries. Aragon sets its own tax rates and thresholds, distinct from national or neighboring regional laws, which impact the taxation of inheritances.

The tax rates vary based on the beneficiary’s relationship to the deceased, with closer relatives generally receiving more favorable treatment in terms of lower tax rates and higher exemptions. Beneficiaries in Aragon should consider these regional specifics when planning their estates to minimize tax liabilities and utilize available allowances effectively.

Seeking advice from tax advisors or legal experts specializing in Aragonese tax law is advisable to ensure compliance with local regulations and optimize tax efficiency.

Asturias: Key Points on Inheritance Tax

In Asturias, key considerations for beneficiaries regarding Inheritance Tax (IHT) include understanding the region’s tax structure and applicable allowances. Asturias imposes tax rates and thresholds, determining the tax liability on inherited assets.

Beneficiaries may qualify for specific allowances, such as deductions for primary residences or assets with cultural or historical significance, aimed at preserving local heritage and supporting family wealth transfer. Close consultation with tax advisors or legal professionals familiar with Asturian tax regulations is essential to navigate these complexities effectively.

By leveraging regional allowances and planning strategies, beneficiaries can mitigate Inheritance Tax liabilities and ensure the smooth transfer of assets according to their wishes and local legal requirements.

Balearic Islands: Regional Inheritance Tax

Inheritance Tax (IHT) in the Balearic Islands involves understanding the region’s distinct tax framework governing the transfer of inherited assets. The Balearic Islands set tax rates and exemptions, which may differ from national or mainland Spanish laws.

Beneficiaries inheriting assets in the Balearic Islands may qualify for specific exemptions and deductions related to primary residences, family businesses, and other regional-specific assets. Beneficiaries should seek professional advice from tax advisors or legal experts familiar with the Balearic Islands’ tax legislation to optimize their tax planning strategies.

By understanding regional nuances and leveraging available allowances, beneficiaries can minimize tax liabilities and ensure compliance with local regulations when transferring assets within the region.

Canary Islands: What to Know About Inheritance Tax

Understanding Inheritance Tax (IHT) in the Canary Islands involves familiarity with the region’s unique tax legislation governing the transfer of assets from deceased individuals to beneficiaries. The Canary Islands have tax rates and thresholds for Inheritance Tax, distinct from those in mainland Spain.

Beneficiaries should know regional exemptions and deductions applicable to inheritances, including allowances for primary residences and family-owned businesses. Consulting with tax advisors or legal experts specializing in the Canary Islands’ tax law is recommended to navigate these complexities effectively.

By optimizing tax planning strategies and complying with local regulations, beneficiaries can minimize Inheritance Tax liabilities and ensure the efficient transfer of assets according to their intentions and legal requirements.

Cantabria: Regional Inheritance Tax Overview

In Cantabria, understanding the Inheritance Tax (IHT) framework is essential for beneficiaries navigating the transfer of assets from deceased individuals to heirs. Cantabria applies its tax rates and thresholds, determining the tax liability on inheritances received.

The region offers specific allowances and deductions, such as exemptions for primary residences and assets with cultural or historical significance, to facilitate family wealth transfer while minimizing tax burdens. Beneficiaries in Cantabria should seek advice from tax advisors or legal professionals well-versed in regional tax laws to optimize their estate planning strategies.

By effectively leveraging regional allowances and planning, beneficiaries can mitigate Inheritance Tax liabilities and ensure compliance with Cantabrian tax regulations when transferring assets within the region.

Castilla y León: Inheritance Tax Explained

Exploring Inheritance Tax (IHT) in Castilla y León involves understanding the region’s specific tax regulations governing the transfer of assets from deceased individuals to beneficiaries. Castilla y León sets its tax rates and thresholds, which vary based on the beneficiary’s relationship to the deceased.

The region offers specific exemptions and deductions, such as allowances for primary residences and certain family assets, to support family continuity and economic activities. Beneficiaries should consult with tax advisors or legal experts specializing in Castilla y León’s tax law to optimize their tax planning strategies.

By navigating regional allowances and planning effectively, beneficiaries can minimize Inheritance Tax liabilities and ensure the smooth transfer of assets according to their intentions and legal requirements within the region.

Castilla-La Mancha: Key Inheritance Tax Insights

In Castilla-La Mancha, beneficiaries must navigate the region’s specific tax regulations governing the transfer of assets through Inheritance Tax (IHT). The region establishes its tax rates and thresholds, determining the tax liability on inherited assets.

Beneficiaries may benefit from specific allowances and deductions, such as exemptions for primary residences and family-owned businesses, designed to support local economic activities and preserve family wealth. Consulting with tax advisors or legal professionals familiar with Castilla-La Mancha’s tax law is essential to optimize tax planning strategies and ensure compliance with regional regulations.

By leveraging available allowances and planning effectively, beneficiaries can minimize Inheritance Tax liabilities and facilitate the efficient transfer of assets according to their preferences and legal obligations.

Cataluña: Comprehensive Guide to Inheritance Tax

A comprehensive understanding of Inheritance Tax (IHT) in Cataluña requires familiarity with the region’s specific tax legislation governing the transfer of assets from deceased individuals to beneficiaries. Cataluña has its own tax rates and thresholds for Inheritance Tax, distinct from national or neighboring regional laws.

Beneficiaries may qualify for regional allowances and deductions related to primary residences, family businesses, and cultural assets to support local economic development and cultural heritage. Consulting with tax advisors or legal experts specializing in Cataluñan tax law is recommended to navigate these complexities effectively.

By optimizing tax planning strategies and complying with regional regulations, beneficiaries can minimize Inheritance Tax liabilities and ensure the efficient transfer of assets according to their intentions and legal requirements within Cataluña.

Comunidad Valenciana: Local Inheritance Tax Rules

In Comunidad Valenciana, beneficiaries must understand the region’s specific Inheritance Tax (IHT) rules governing the transfer of assets from deceased individuals to heirs. The region applies tax rates and exemptions, which may differ from national or neighboring regional laws.

Beneficiaries inheriting assets in Comunidad Valenciana may qualify for specific exemptions and deductions related to primary residences, family businesses, and other regional-specific assets. To optimize tax planning strategies, seek advice from tax advisors or legal experts specializing in Comunidad Valenciana’s tax legislation.

By understanding regional nuances and leveraging available allowances, beneficiaries can minimize tax liabilities and ensure compliance with local regulations when transferring assets within the region.

Extremadura: Understanding Inheritance Tax

Understanding Inheritance Tax (IHT) in Extremadura involves navigating the region’s specific tax regulations governing the transfer of assets from deceased individuals to beneficiaries. Extremadura sets its tax rates and thresholds, determining the tax liability on inherited assets.

Beneficiaries may qualify for specific allowances, such as deductions for primary residences or assets with cultural or historical significance, aimed at preserving local heritage and supporting family wealth transfer.

Consulting with tax advisors or legal professionals familiar with Extremaduran tax regulations is essential to navigate these complexities effectively. By leveraging regional allowances and planning strategies, beneficiaries can mitigate Inheritance Tax liabilities and ensure the smooth transfer of assets according to their intentions and legal requirements within Extremadura.

Galicia: Regional Inheritance Tax Details

In Galicia, beneficiaries must understand the region’s specific Inheritance Tax (IHT) details governing the transfer of assets from deceased individuals to heirs. The area has its tax legislation governing Inheritance Tax rates, exemptions, and allowances, distinct from national or neighboring regional laws.

Beneficiaries may qualify for exemptions and deductions related to primary residences, family businesses, and other specific assets within Galicia. Seeking advice from tax advisors or legal experts specializing in Galician tax law is recommended to optimize tax planning strategies effectively.

By understanding regional nuances and leveraging available allowances, beneficiaries can minimize tax liabilities and ensure compliance with local regulations when transferring assets within Galicia.

Madrid: Inheritance Tax Essentials

Understanding Inheritance Tax (IHT) essentials in Madrid involves familiarity with the region’s specific tax framework governing the transfer of assets from deceased individuals to beneficiaries.

Madrid sets its tax rates and thresholds for Inheritance Tax, which vary based on the beneficiary’s relationship to the deceased. The region offers specific exemptions and deductions, such as allowances for primary residences and certain family assets, to support family continuity and economic activities.

Beneficiaries should consult with tax advisors or legal experts specializing in Madrid’s tax law to optimize their tax planning strategies. By navigating regional allowances and planning effectively, beneficiaries can minimize Inheritance Tax liabilities and ensure the smooth transfer of assets according to their intentions and legal requirements within Madrid.

Murcia: Local Inheritance Tax

Inheritance Tax (IHT) in Murcia involves understanding the region’s specific tax regulations governing the transfer of assets from deceased individuals to beneficiaries. Murcia imposes tax rates and thresholds, determining the tax liability on inherited assets beneficiaries receive.

The region may offer specific allowances and deductions, such as exemptions for primary residences or assets with cultural or historical significance, to support local heritage and family wealth transfer. Beneficiaries should seek advice from tax advisors or legal professionals knowledgeable about Murcian tax law to optimize their tax planning strategies effectively.

By leveraging regional allowances and planning proactively, beneficiaries can mitigate Inheritance Tax liabilities and ensure compliance with local regulations when transferring assets within Murcia.

What Happens to Unclaimed Inheritances in Spain?

In Spain, unclaimed inheritances follow a legal process governed by inheritance laws. When they remain unclaimed, an inheritance becomes part of the deceased person’s estate. The assets may then be distributed according to the deceased’s will or, if there is no will, according to the rules of intestate succession.

This process involves identifying and locating potential heirs and beneficiaries. The assets may eventually be escheated to the state if no heirs can be found.

To learn more about the legal processes surrounding unclaimed inheritances in Spain, visit Marfour for comprehensive insights and guidance on inheritance laws.

Inheritance Tax Obligations in Spain

In Spain, inheritance tax (IHT) is levied on the transfer of assets from a deceased person to their heirs or beneficiaries. The tax rates and exemptions vary depending on several factors, including the relationship between the deceased and the beneficiary, the value of the inherited assets, and the region where the deceased resided.

Beneficiaries are responsible for reporting and paying any applicable inheritance tax to the relevant tax authorities. Explore Marfour for detailed explanations of inheritance tax obligations in Spain, including tax rates, exemptions, and regional variations, to ensure compliance with Spanish tax laws.

Taxing Overseas Property and Assets: Spain’s Rules

Spain taxes overseas property and assets owned by Spanish residents. Residents must declare all worldwide income and assets to the Spanish tax authorities, including those held abroad.

Failure to declare overseas property and assets can result in penalties and legal consequences. Various factors, such as residency status and double taxation treaties, may influence the taxation of overseas property and assets in Spain.

For comprehensive guidance on understanding Spain’s rules regarding the taxation of overseas property and assets, visit Marfour, where you can find valuable insights and resources to ensure compliance with Spanish tax regulations.

Do You Need a Spanish Will for Your Property?

A Spanish will streamline the inheritance process and ensure your assets are distributed according to your wishes during your death. While foreigners don’t need a Spanish will for their Spanish property, it is highly recommended.

A Spanish will help avoid delays, legal complications, and potential disputes among heirs. Additionally, it allows you to specify how you want your assets distributed and appoint executors to manage your estate.

Discover the importance of having a Spanish will for your property on Marfour, where you can access expert advice and resources to help you create a comprehensive estate plan tailored to your needs and preferences.

Spousal Inheritance Tax: What Are the Rules?

In Spain, spouses and registered partners are generally entitled to certain tax benefits and exemptions when inheriting assets from each other. The exact rules and exemptions vary depending on factors such as the region where the deceased resided and the value of the inherited assets.

Spouses may benefit from reduced inheritance tax rates or complete exemptions on certain assets, such as the family home.

Learn about the rules and tax benefits surrounding spousal inheritance tax in Spain by visiting Marfour, where you can find detailed explanations and expert insights to help you navigate the complexities of inheritance tax laws.

What’s the timeline for IHT?

Inheritance tax (IHT) in Spain must be paid within six months of death. Within the first five months, an extension of six additional months can be requested.

Is there a penalty for late payment?

Yes, there are penalties for late payment, including interest charges and potential fines, which increase the longer the payment is delayed.

Is IHT the same everywhere in Spain?

IHT is different everywhere in Spain. Each autonomous region has the authority to set regulations and allowances, leading to significant differences.

How do I know which IHT regional law to apply to my case?

The applicable regional law is determined by the region where the deceased had their habitual residence during the five years before their death.

Do non-residents pay higher taxes than residents?

Generally, non-residents may face higher taxes than residents, as they are subject to national regulations without regional benefits and allowances.

How is IHT calculated?

IHT is calculated based on the value of the inherited assets, applying the relevant tax rate, which varies depending on the relationship between the deceased and the beneficiary and the beneficiary’s pre-existing wealth.

What determines IHT allowances in Spain?

IHT allowances in Spain are determined by the relationship between the deceased and the beneficiary, with closer relatives usually benefiting from higher allowances. Regional laws can also affect these allowances.

What other IHT tax allowances exist in Spain?

Other IHT tax allowances in Spain can include reductions for the inheritance of a main residence, business assets, and beneficiaries with disabilities. The specific allowances vary by region.

Frequently Asked Questions (FAQs) on Spanish Inheritance Law:

Here are some frequently asked questions (FAQs) and a conclusion on Spanish Inheritance Law:

What is Inheritance Tax (IHT) in Spain?

Inheritance Tax in Spain is a tax on transferring assets from a deceased person to their heirs or beneficiaries. The tax rates and exemptions vary depending on factors such as the relationship between the deceased and the beneficiary, the value of the inherited assets, and the region in Spain.

Do I need to pay Inheritance Tax in Spain?

Beneficiaries receiving inherited assets in Spain are generally liable to pay Inheritance Tax. The tax obligations and rates depend on various factors, including the value of the inheritance and the beneficiary’s relationship to the deceased.

Are there exemptions or deductions available for Inheritance Tax in Spain?

Yes, Spain offers various exemptions and deductions for Inheritance Tax, including allowances for primary residences, family-owned businesses, and specific assets with cultural or historical significance. These exemptions can help reduce beneficiaries’ overall tax liability.

Do non-residents in Spain pay higher Inheritance taxes?

Non-residents inheriting assets in Spain may face higher Inheritance Tax rates than residents. It’s essential to consider residency status and seek advice from tax professionals to understand the implications and optimize tax planning strategies.

What happens if an inheritance is left unclaimed in Spain?

Unclaimed inheritances in Spain typically follow a legal process where the assets become part of the deceased person’s estate. If one exists, the distribution of these assets then follows the rules of intestate succession or according to the deceased’s will.

Conclusion

In conclusion, Spanish Inheritance Law requires careful consideration of regional variations and tax implications. At Marfour, we offer comprehensive resources and expert guidance to help you effectively understand and manage your inheritance matters in Spain.

From Inheritance Tax obligations to understanding legal nuances, our tailored advice ensures you can confidently plan for the transfer of assets according to your wishes and comply with Spanish regulations. Trust Marfour to empower you with the knowledge needed to navigate complexities and optimize your estate planning strategies seamlessly in Spain.